In the world of finance, Bitcoin has emerged as a unique asset class, defying traditional...

Time Locking Bitcoin

As we delve into the intriguing landscape of Bitcoin, we would like to extend a heartfelt thanks to Joe Burnett for hosting a riveting discussion with Peter on the topic of time-locking Bitcoin and its potential as pristine collateral. The insights shared during this conversation not only shed light on the unique properties of Bitcoin but also provided a forward-looking perspective on its role in the global banking system. As we embark on this exploration of Bitcoin as a "black hole" to the global banking system, I am sure that the ideas presented here, inspired by Joe and Peter's conversation, will prompt further thought and discussion. So, let's dive in.

The financial world is constantly evolving, yet few inventions have been as transformative or controversial as Bitcoin. Created in 2008 by an unknown person or group of people using the name Satoshi Nakamoto, Bitcoin emerged as a decentralised digital currency, free from government regulation or control. Over a decade later, it stands as a unique asset class that, despite volatility, has demonstrated extraordinary potential to reshape our economic landscape. This article will explore how Bitcoin could become a disruptive force, or rather a "black hole," in the global banking system.

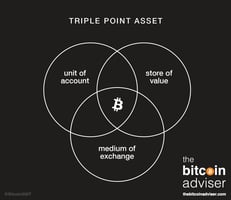

The Triple Point Asset: Understanding Bitcoin

The unique properties of Bitcoin distinguish it from other assets. It acts as a "triple point asset," meaning it simultaneously fulfils all three functions of money. Firstly, it serves as a store of value, comparable to gold but superior due to its absolute digital scarcity and resistance to seizure. Secondly, it functions as a medium of exchange, akin to the US dollar, but with a predictable and immutable supply and censorship resistance. Finally, it could serve as a unit of account, providing a revolutionary improvement in the accounting system due to Bitcoin's immutable ledger.

Time Locking: A Unique Bitcoin Feature

Bitcoin has a unique feature known as time-locking, which allows a user to "lock" their Bitcoin so that it cannot be accessed until a certain point in time or block height in the future. This could potentially protect against potential attacks, including the breaking of SHA-256, the cryptographic algorithm used in Bitcoin. The reason being that time-locked Bitcoin isn't technically "in" a wallet at any block height, hence it can't be stolen even if the SHA-256 is compromised.

Additionally, Bitcoin's time-locking feature could help mitigate duration risk. This refers to the financial risks associated with time, including interest rate risk, inflation rate risk, and exchange rate risk. By locking the value of Bitcoin into the future, it provides a more predictable and secure financial outlook.

Bitcoin and the Bond Market

The bond market, a cornerstone of global finance, is experiencing shifts with major bond purchasers like Chinese and Japanese governments reducing their bond allocations. As a result, concerns are arising that central banks such as the Federal Reserve might become the buyer of last resort, stepping in to purchase bonds.

To instil confidence in bonds, they could be backed by hard assets like gold or Bitcoin. For instance, if $100 billion worth of bonds are sold, $5 billion in gold or Bitcoin could be used to back them. This could potentially incentivise more people to purchase long-term bonds.

Bitcoin as Collateral: The Quantum Asset

The potential for Bitcoin to be used as collateral for bond purchases could be significant. By time-locking Bitcoin, it can be sent through time without losing its value due to inflation, deflation, or other financial fluctuations. This could lead to a fundamental shift in finance, resulting in an inverted yield curve where longer-term bonds have lower yields than short-term bonds, contrasting with traditional finance.

Moreover, Bitcoin's potential as a "pristine collateral" offers new, flexible borrowing options. The ability to borrow against Bitcoin could disrupt traditional finance, with some speculating that banks might pay you to borrow from them if you put up Bitcoin as collateral. This depends on whether Bitcoin is classified as a currency or property.

Bitcoin as a Survival Asset

Bitcoin's survival into the future seems highly probable compared to other digital structures. This makes Bitcoin a reliable asset to secure and transfer wealth over time, creating a singularity in economics.

If credit markets fully recognise the potential of Bitcoin as collateral, it could lead to a surge in demand, possibly resulting in hyperbitcoinisation – a state where Bitcoin becomes the world's dominant form of money.

Bitcoin: The Black Hole of the Banking System

The growing recognition of Bitcoin's value as a robust collateral can result in Bitcoin becoming a black hole in the global banking system. Here, the term "black hole" is used metaphorically to describe an influential force that other entities (like fiat currencies) cannot escape from. Once credit markets recognize the immense potential of Bitcoin as collateral, it could trigger a wave of demand, possibly leading to hyperbitcoinisation.

In this context, it's interesting to consider the implications of negative interest rates. In a scenario where banks accept Bitcoin as a high-quality collateral, they might be incentivised to lend at negative interest rates. That means they would effectively pay borrowers who put up Bitcoin as collateral. The logic here is that banks could then use this Bitcoin as an asset to issue more loans, thereby generating more revenue. They could share a portion of these profits with the borrower in the form of negative interest.

Bitcoin's Time-Locked Potential

Bitcoin's time-locking feature could play a significant role in reducing counterparty risk, which is the risk that the other party in a contract will not live up to their contractual obligations. By locking Bitcoin for a specific time period, the level of trust required between counterparties could be significantly reduced. This could eventually lead to a greater integration of Bitcoin within the existing financial system, making it a more accepted and sought-after form of collateral.

This, in turn, could amplify demand, triggering what some refer to as hyperbitcoinisation – a state where Bitcoin is so widely accepted that it effectively becomes the world's leading form of money.

Evolving the System and Future Risks

As we continue to evolve our financial systems, we should consider the insights of thinkers like Jeff Booth, who advocates for seeing value systems from within the system. It's crucial to understand that we are transitioning towards a future that might seem unimaginable today.

There are risks to consider, of course. Multi-signature (multi-sig) wallets, which provide an additional layer of security, aren't fully functional with time-locking yet. Also, the risk of wallet compromise becomes more problematic when your Bitcoin is time-locked. And let's not forget the risk of "buyer's remorse," where someone might regret time-locking their Bitcoin and can't undo the transaction.

However, these challenges can be addressed as our understanding and technology evolve, opening the door to potential use cases for time-locked Bitcoin in areas like collateral for bonds or mortgages, children's education funds, annuity streams, and estate planning.

Bitcoin in the Banking System

The integration of Bitcoin into the mainstream banking system appears inevitable. Over the next five to six years, we can expect more banks to begin using Bitcoin as collateral. This adoption could drive Bitcoin's price significantly higher as it becomes integrated into larger financial markets.

When considering Bitcoin as collateral, it arguably outperforms even global real estate, the current largest asset class. If Bitcoin is accepted as superior collateral, its market cap could potentially reach the size of the global real estate market, affirming its place as a significant player in the global economy.

Final Thoughts: Bitcoin as a Hedge

The opportunities and challenges presented by Bitcoin are fascinating. Given its disruptive potential and its status as a survival asset, it makes sense to consider holding at least 5-10% of your net assets in Bitcoin as a hedge against the traditional system. While some may prefer Bitcoin to remain outside the system, it needs to integrate with traditional financial markets to facilitate wider adoption and growth.

Bitcoin's role as a potential black hole in the banking system underscores its transformative potential. While the journey towards this future may be fraught with volatility and uncertainty, the potential rewards could be monumental. And in this ever-evolving world, being open to such opportunities.