Bitcoin has revolutionized finance, offering unparalleled growth potential. Yet, for long-term...

The Importance of Bitcoin Estate Planning: Safeguarding Your Bitcoin

Estate Planning Often an After Thought

Estate planning often remains an afterthought despite its crucial role in wealth management. This oversight extends beyond traditional assets and applies even to the world of Bitcoin. Shockingly, recent surveys indicate that a significant percentage of adults in both the United States and Australia lack a will or any form of estate planning document. According to a 2021 survey conducted by Caring.com, only 32.9% of US adults possess such documents, while in Australia, approximately 45% of individuals have never engaged in estate planning.

The consequences of this neglect are far-reaching, leaving substantial assets and investments susceptible to mishandling during unforeseen circumstances. However, when it comes to Bitcoin, a digital bearer asset, estate planning becomes even more critical. Given its unique nature and increasing presence in investment portfolios, Bitcoin necessitates careful, multi-faceted estate planning to ensure a secure and seamless transition of these digital assets to heirs.

In this article, we will explore the importance of estate planning, delve into the general issues associated with a lack of estate plans, and specifically address the challenges and considerations that arise when a significant percentage of an individual's estate comprises Bitcoin. By understanding the significance of estate planning and adopting a comprehensive approach, individuals can safeguard their assets, protect their loved ones' interests, and ensure the smooth transfer of Bitcoin and other assets to future generations.

Understanding Customer Considerations

Estate planning, in general, isn't a particularly pleasant topic for most individuals. It forces us to confront mortality, and the tasks involved can seem daunting, especially when complex assets like Bitcoin are involved. As a result, it's often put off for later, but this lack of planning can lead to substantial complications down the line.

With Bitcoin, this becomes even more complex due to its unique characteristics. Bitcoin is a digital bearer asset, meaning whoever holds the private keys effectively owns the Bitcoin associated with those keys. This differs from traditional assets where ownership is tied to an individual's identity and can be more easily transferred through legal processes.

Estate Planning Components and Bitcoin's Unique Nature

When planning for Bitcoin inheritance, the following considerations must be accounted for:

-

Legal and Probate Process: A legal framework is needed to outline clear instructions on how to access and transfer the Bitcoin upon the owner's demise. This should align with your local jurisdiction's inheritance laws and may require consultation with a legal expert well-versed in cryptocurrency regulations.

-

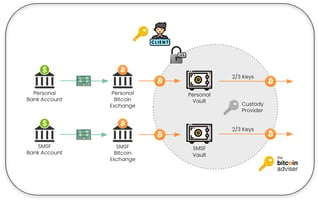

Physical Transfer of Funds: A structured plan should be in place detailing how heirs can access and transfer the Bitcoin holdings. This can involve secure storage solutions, such as hardware wallets or multi-signature wallets, and should include comprehensive instructions on accessing and managing these wallets. It's essential to maintain security in this process to prevent unauthorised access or loss of funds.

-

Education of Heirs: Given the technical nature of Bitcoin, it's critical that heirs understand how to manage their inherited Bitcoin effectively. This includes understanding Bitcoin's value proposition, handling procedures, and the necessary security precautions. Providing resources or educational materials to heirs can help them navigate the complexities of Bitcoin and ensure they make informed decisions regarding their inherited wealth.

The Implications of Inherited Bitcoin Wealth

Inheriting Bitcoin could potentially bestow significant wealth upon your heirs, especially with predictions of Bitcoin's value reaching well over $1+ million in the future. Preparing your heirs for this potential wealth involves not just the technical side of managing Bitcoin but also imparting knowledge about responsible wealth management and the implications of newfound wealth.

The Bitcoin Adviser's Role in Estate Planning

The Bitcoin Adviser takes immense pride in our unwavering commitment to the security and protection of our clients' Bitcoin holdings. We are thrilled to share that throughout our history, we have never lost a single satoshi. This impeccable track record underscores our dedication to maintaining the highest standards of security and custodial practices.

In the realm of Bitcoin estate planning, we understand that finding the right balance of trade-offs between security, safety, and backup mechanisms is paramount. We recognise that while stringent security measures are crucial, overly complex or cumbersome processes can hinder the seamless execution of estate planning. That's why we have developed a service that carefully considers these factors, ensuring that your estate planning processes can run smoothly without any hiccups.

Our team of experts possesses extensive knowledge and experience in navigating the intricacies of Bitcoin estate planning. We are well-versed in the best practices for securely storing and transferring Bitcoin, leveraging cutting-edge technology and industry-leading protocols. By leveraging our expertise, you can trust that your Bitcoin investments will be safeguarded throughout the estate planning process.

Furthermore, we understand that estate planning is a deeply personal matter, and we approach each client's needs with empathy and understanding. We take the time to listen to your unique circumstances, preferences, and goals, tailoring our services to meet your specific requirements. Our aim is to provide you with peace of mind, knowing that your Bitcoin holdings will be handled with the utmost care and precision.

Conclusion

Estate planning is a vital aspect of wealth management that should not be overlooked. While it may be uncomfortable to confront, failing to plan can lead to significant complications, especially when complex assets like Bitcoin are involved. Recognising the unique nature of Bitcoin and addressing its specific considerations in estate planning is essential to ensure a secure and seamless transition of these digital assets to your heirs.

By seeking guidance from professionals with expertise in Bitcoin estate planning, such as The Bitcoin Adviser, you can navigate the complexities of the process, protect your assets, and provide your loved ones with the knowledge and resources they need to effectively manage their inherited Bitcoin wealth. Don't delay in securing your financial legacy – start your Bitcoin estate planning journey today.

To become a client and learn more about The Bitcoin Adviser, contact us today.