A common dilemma Many newcomers to Bitcoin often face a common dilemma: they don't yet have a...

Understanding Bitcoin Custody

This guide aims to demystify Bitcoin custody, providing you with a comprehensive overview of the various custody options, from keeping funds on an exchange to using hardware devices, multi-signature wallets, and collaborative custody solutions. We also explore the concept of hot wallets, a popular choice for those who frequently transact in Bitcoin.

Each custody option comes with its unique set of advantages and disadvantages, and understanding these is crucial to making an informed decision that aligns with your investment goals and risk tolerance, there is no right answer to Bitcoin Custody, just trade offs, we hope this guide helps explain those and why the Bitcoin Adviser chooses Collaborative Custody.

Whether you're a seasoned investor new to the world of Bitcoin or a tech-savvy entrepreneur looking to secure your Bitcoin, this guide will equip you with the knowledge you need to navigate the Bitcoin custody landscape with confidence. Let's dive in.

Keeping Funds on an Exchange (Do Not Do This)

Exchanges are online platforms where you can buy, sell, and hold Bitcoin. They are similar to online banks. When you keep your Bitcoin on an exchange, the exchange has custody of your Bitcoin, much like a bank has custody of your money when you deposit it.

Pros

- Ease of Use: It's simple to set up and use, especially for beginners.

- Accessibility: Your funds are readily available for trading.

- Features: Many exchanges offer additional features like trading pairs, lending, staking, etc. However, these can also be considered risky.

Cons

- Centralisation: Exchanges are centralised entities, making them targets for hackers.

- Lack of Control: The exchange holds your private keys, meaning you don't have full control over your funds and it can be near impossible to validate that they are actually holding your Bitcoin.

- Regulatory Risk: Exchanges can freeze assets or shut down due to regulatory issues.

- Counterparty Risk: There's a risk that the exchange could default on its obligations to you. If an exchange fails to allow you to withdraw the funds, you're a victim of that counterparty failing to meet its obligations to you.

- Bankruptcy Risk: If an exchange goes bankrupt, your funds could be lost forever, or you might only receive a fraction of your funds back after a long period of time. Even if the exchange has insurance, it may only cover specific cases and may not list you as a beneficiary.

Hot Wallet (Mobile Wallet / App, for Small Amounts)

A hot wallet is a digital wallet that is always connected to the internet and the Bitcoin network. It's like an online bank account for your Bitcoin. Hot wallets allow you to send, receive, and store your Bitcoin, and they provide an interface for you to interact with the Bitcoin network.

Pros

- Accessibility: Hot wallets are always connected to the internet, making them readily accessible for transactions.

- Variety: There are many types of hot wallets available, many of which are free to download. Some are designed for specific cryptocurrencies or ecosystems, and some are linked with specific exchanges.

- Convenience: Hot wallets are ideal for conducting regular transactions and for storing small amounts of Bitcoin that you might need for immediate or near future use.

Cons

- Security Risks: Because hot wallets are connected to the internet, they are more vulnerable to hacks and theft than cold storage methods. The public and private keys are stored on the internet, which can be a potential security risk.

- Responsibility: As with other forms of Bitcoin custody, you are responsible for the security of your hot wallet. This includes keeping your software up to date, encrypting your wallet, and keeping your password secure.

Single Signature Custody Using a Hardware Device (e.g., Ledger, Trezor, Cold Card)

A hardware wallet is a physical device that securely and isolatedlye generates the private keys necessary for you to spend your Bitcoin. It's like a secure USB stick that holds your Bitcoin information.

Pros

- Control: You have full control over your private keys and therefore your funds.

- Security: Hardware wallets are designed to keep your private keys offline and secure. They offer protection against both remote and physical attacks. The keys are generated and stored within the device.

- Travel-Friendly: Hardware wallets offer convenience and security for traveling with Bitcoin.

- Interoperability: The BIP39 seed phrases are interoperable among hardware wallets that support the standard, which means you can recover your bitcoin wallet backup (seed phrase) to another brand of hardware wallet.

Cons

- Responsibility: If you lose your hardware wallet or forget your pin, you could lose access to your funds.

- Usability: It can be less user-friendly, especially for beginners.

Multi-Sig 2 of 3 Using something like Sparrow Wallet

A multi-signature (multi-sig) wallet requires multiple private keys to authorise a Bitcoin transaction. It's like a safe deposit box that requires two keys to open. In a 2-of-3 multi-sig setup, you have three keys and at least two are required to spend your Bitcoin.

Pros

- Enhanced Security: Multiple signatures are required to access funds, reducing the risk of theft.

- Redundancy: If one key is lost, the other two can still access the funds.

- Ideal for Large Amounts: Multisig wallets are often used for securing larger amounts of Bitcoin.

- Flexibility: You don't need to have all your keys in the same place at the same time to spend bitcoin. You can sign a transaction in one location with one key and sign a day later in another location with the other.

- Fault-Tolerance: In all bitcoin multisig setups where m (the number of keys required to sign) is less than n (the total number of keys in the quorum), you are protected from single points of failure and can still recover your funds in the case that one or more critical items are lost, stolen or otherwise compromised.

Cons

- Complexity: Setting up and managing a multi-sig wallet by yourself can be complex and challenging for the average bitcoiner.

- Responsibility: You are responsible for safely storing multiple keys securely. You also need to be cautious of not making your security so complicated that you struggle to access your funds when needed.

Collaborative Custody (e.g., The Bitcoin Adviser Solution)

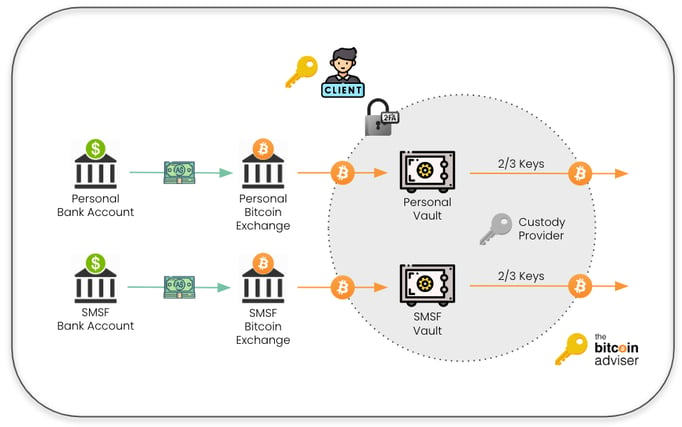

Collaborative custody is a model where the responsibility of safeguarding keys in a 2 of 3 Multi-Sig is shared between you the client, The Bitcoin Adviser, and a service / vault provider. It's like a safety deposit box where three people have keys, and at least two keys are needed to open the box.

Pros

- Security: The multi-sig approach provides enhanced security as above.

- Support: You have the support of a trusted adviser and a service provider and can work with either to access funds.

- Flexibility: You can construct multiple multisig wallets using the same devices so you can separate your personal funds from your pension funds as an example.

- Fault-Tolerance: Similar to the multi-sig setup, the collaborative custody model also provides protection from single points of failure. Even if one key is compromised, you can still recover your funds and swap keys out should it be required.

- Interoperability: The platform is designed to eliminate all single points of failure, including the platform itself. If the platform were to cease to exist or have significant downtime, you can always recover access to your vault outside the platform with compatible software. Similarly if you no-longer wanted to work with the Bitcoin Adviser you can work with the Vault Provider to swap out our key.

- Trust: This is a trustless solution, you as the client maintain control over your funds, you have control over the 2FA on your account and therefore the security of the solution with The Bitcoin Adviser in place to help should anything happen to you or your keys.

- Education: The Bitcoin Adviser works with you and your beneficiaries to ensure everyone has the knowledge required to understand bitcoin, your investment and how to access or inherit funds when required.

- Working with an expert ensures you’re benefiting from the best technical solution that works for other clients, provides the best trade-offs to deliver peace of mind.

Cons

-

Cost: There is a nominal 1% per annum fee for this including all of our services, which we believe represents great value for money and peace of mind.

We hope this helps you understand the different Bitcoin custody options. Remember, the choice of custody option depends on individual needs and circumstances. It's important to do thorough research and consider seeking advice from a professional before making a decision.