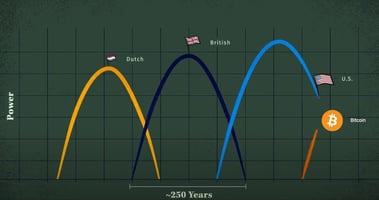

In an era marked by high inflation, concerns over currency debasement and runaway national debt,...

Bitcoin IRAs: Navigating Compliance, Security, and Legacy

The world of Bitcoin investment continues to evolve rapidly, with new opportunities emerging at the intersection of digital assets and traditional financial structures. Among these, Bitcoin IRAs (Individual Retirement Accounts) stand out as a promising avenue for those seeking long-term exposure to Bitcoin within a tax-advantaged framework. However, the regulatory landscape and custody challenges present unique hurdles, highlighted by the pivotal McNulty v. Commissioner case.

At The Bitcoin Adviser, we specialize in guiding clients through these complexities. By leveraging our expertise in secure Bitcoin custody and collaborative partnerships with leading IRA custodians, exchanges, and wallet providers, we ensure that our clients achieve the perfect balance of security, compliance, and control.

What the McNulty Case Means for Bitcoin IRAs

The 2021 McNulty v. Commissioner ruling underscores the importance of adhering to strict legal and custodial requirements when managing alternative assets in an IRA. This case specifically scrutinized “checkbook control” IRAs, where individuals directly manage investments through entities like LLCs. The court reinforced that IRA assets must remain under the custody of a licensed financial institution to avoid violations such as "constructive receipt," which could trigger premature tax penalties.

Bitcoin, as a non-traditional asset, magnifies these challenges due to its unique custody requirements. This ruling serves as a cautionary tale, emphasizing the need for IRA solutions that integrate robust compliance and security protocols while preserving the inherent benefits of Bitcoin.

The Bitcoin Adviser’s Solution: Simplified, Compliant, and Secure IRAs

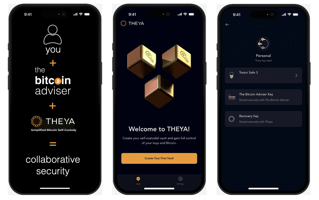

We simplify Bitcoin IRA investments by eliminating the complexities of intermediary entities like LLCs. Partnering with specialized custodians and exchanges, we implement a streamlined, multisignature (multisig) custody model where Bitcoin is held in the "For Benefit Of" (FBO) account holder format. Here’s how this model stands out:

1. Multisig Custody

Our collaborative custody approach uses a 2-of-3 multisignature configuration:

- The client holds one key, maintaining direct partial control.

- The Bitcoin Adviser holds a backup key for recovery or emergencies.

- A trusted custodian holds the third key, ensuring alignment with IRS regulations.

This structure eliminates single points of failure, enhancing security while adhering to compliance requirements.

2. Regulatory Compliance

Designed with ultra-conservative legal safeguards, our custodial partnerships ensure that all transactions are initiated and supervised by the IRA custodian. This framework prevents "constructive receipt" issues and ensures alignment with McNulty’s principles, offering clients peace of mind.

3. Transparency and Control

Clients enjoy full visibility into their holdings through the blockchain while retaining control of their private keys. Transactions require dual signatures, ensuring no single entity can act unilaterally.

4. Enhanced Estate Planning

Our service goes beyond mere custody. We integrate comprehensive estate planning protocols, ensuring your Bitcoin can seamlessly transition to heirs in the future. This includes beneficiary education to bridge the knowledge gap often found in Bitcoin ownership.

Why Choose The Bitcoin Adviser for Your Bitcoin IRA?

The Bitcoin Adviser combines cutting-edge security with personalized service to help clients navigate the intricate landscape of Bitcoin IRAs. Here’s what sets us apart:

- Customized Solutions: We understand that no two clients are the same. Whether you’re rolling over an existing IRA or starting fresh, we tailor our services to fit your unique objectives.

- Expert Guidance: Since 2016, we’ve worked with high-net-worth clients, estate planners, and custodians to ensure Bitcoin is securely managed and passed on to future generations.

- Legacy-Focused Planning: Our estate plan protocols ensure your Bitcoin wealth transcends generations, preserving its long-term value.

- Transparency in Fees: With a straightforward 1% annual fee, payable in Bitcoin (sats), you gain access to a comprehensive suite of services including multisig wallet setup, estate planning, and ongoing support.

Looking Ahead: Your Path to a Secure Bitcoin Legacy

Bitcoin IRAs represent a groundbreaking fusion of digital assets and traditional retirement planning. Yet, their successful implementation requires meticulous attention to both regulatory and custodial aspects. At The Bitcoin Adviser, we bridge this gap with innovative custody solutions that simplify compliance and maximize security.

We invite you to explore how a Bitcoin IRA could align with your financial goals and secure your Bitcoin legacy. Contact us today to learn more or schedule a consultation. Together, let’s redefine the future of wealth preservation.

To learn more book a meeting with our resident IRA expert Scott.