As you've no doubt realised, Bitcoin isn't just a fringe experiment anymore. It has become a...

How I Lost $6 Billion Dollars by Leaving Bitcoin on an Exchange

Centralised exchanges have long been the go-to platforms for buying, selling, and storing Bitcoin. While they offer convenience, they come with significant risks that can lead to devastating losses.

Don’t Touch the Stove

Despite numerous stories of loss, people still trust centralised exchanges, often ignoring the security breaches and regulatory uncertainties. From Mt. Gox to recent failures like FTX, BlockFi, and Celsius, the risks are clear.

The Cost of Tuition

An essential metric is the minimum Compound Annual Growth Rate (CAGR) of holding Bitcoin for over six years. As of mid-2024, this stands at +45%. If I hadn't lost 1.56 Bitcoin with Celsius, it would be worth around $90,000 today. Over 30 years, with a 45% CAGR, that could grow to over $6 billion. Even at lower rates of return, the loss is staggering:

- 45% CAGR: $6,241,408,046.10

- 30% CAGR: $235,000,000

- 20% CAGR: $21,000,000

- 15% CAGR: $6,000,000

- 10% CAGR: $1,500,000

The Lesson Learned

You can't close the gate after the horse has bolted. Reflect on how you value your Bitcoin. Is your custody model respecting that value? Whether it's on an exchange, a hardware wallet, or a piece of paper, ensure your security model is appropriate.

Take Action

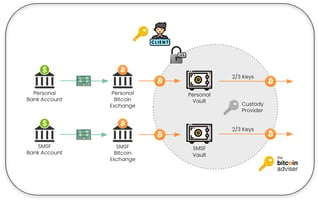

Secure your Bitcoin today. At The Bitcoin Adviser, we believe in collaborative security to safeguard your assets and ensure they can be inherited by your beneficiaries. Don't wait to learn the hard way—book a meeting with us to explore how we can help you protect your Bitcoin and grow your wealth with cutting-edge strategies.