In the evolving landscape of Bitcoin security, the concept of a 'key agent' has emerged as a...

Addressing the Collusion Question

Ensuring Collusion is Impossible in Our Collaborative Custody Model

As we get into deeper conversations with clients at The Bitcoin Adviser, a crucial question we often address is:

"What's stopping The Bitcoin Adviser and The Platform Provider from colluding to steal my funds?"

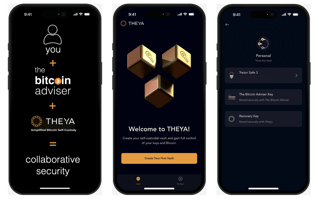

We fully acknowledge the fundamental Bitcoin principle of 'not your keys, not your coins,' and its significance in maintaining control and security over your Bitcoin. In our collaborative custody model, where you, as the client, hold one of three keys in a 2-of-3 setup, we absolutely preserve this essential tenet.

This article outlines how our trustless protocol and comprehensive security measures uphold the integrity of your Bitcoin. We ensure that holding only one key in this multi-signature arrangement does not compromise the security of your Bitcoin but in fact delivers resilience and removes any single point of failure avoiding the possible loss of funds through you the client making a mistake with your setup.

Moreover, our model is meticulously designed to negate any possibility of collusion between the other two key holders. We are committed to demonstrating that while you are part of a collaborative custody multisig with The Bitcoin Adviser, the control and security of your funds remain uncompromised, making the scenario of collusion not just improbable, but technically and physically impossible.

Self-Custody and Empowerment

Clients choosing The Bitcoin Adviser are empowered through self-custody. You're not entrusting us with your Bitcoin; you're actively managing your own assets. Our role is as a trusted guide, assisting in the setup of a collaborative custody security model. This empowers you to manage your key in your own account, ensuring your key is safe and you are the sole individual with access and control from the outset.

Trustless Setup

Our process is inherently trustless. You the client have complete autonomy over your account setup, including creating usernames, passwords, and implementing Two-Factor Authentication (2FA). This ensures that you are the sole individual with access to your account. We provide guidance and explanation at every step, but control always remains in your hands.

Our Role as Adviser, Key Agent and More

As advisers and key agents, we offer comprehensive guidance on Bitcoin security and collaborative custody. While we assist through the setup process and answer questions, it is essential to note that you the client maintain control of your accounts and key at all times. To learn more about our role beyond a key agent you can read more here.

Collaborative Custody with Multiple Technology Providers

At The Bitcoin Adviser, our approach to safeguarding your Bitcoin assets involves partnering with a variety of technology providers to develop robust, multisig vaults. This strategy of diversification brings several key advantages:

-

Varied Key Management Protocols: Our collaboration with multiple technology providers ensures a diverse range of key management protocols, each characterised by unique, proprietary security methods. This diversity not only presents a complex landscape for potential bad actors, deterring uniform attack vectors, but also incorporates several critical features to enhance security and client awareness.

Each provider's approach to key management is structured so that only a select group of individuals have access to the keys. These keys are used under strict conditions, with usage being subject to stringent restrictions and regular audits. Additionally, our providers implement comprehensive notification systems, broadcasting alerts to users at every step of the process.

This ensures that you, as the client, are always informed of all activities, reinforcing transparency and control. Such notifications are crucial not just for keeping you apprised of the transactions you are performing, but also for providing reassurance that you are fully aware of any activity occurring within your account.

This multilayered approach to key management and client communication forms a critical part of our commitment to maintaining the highest standards of security and client empowerment in our custody solution.

-

Agility in Response to Provider Issues: Our structure as a two-of-three multisig model provides us with the flexibility to react swiftly in the unlikely event of an issue with a provider. Being a key holder and in conjunction with you the client, The Bitcoin Adviser can work with you to facilitate a seamless transition to another provider without any compromise to the security or accessibility of your assets. This agility ensures continuity and reliability in managing your Bitcoin.

-

Interfacing with the Blockchain: It’s important to understand that these technology providers serve primarily as user interfaces to the blockchain. The actual funds are always on the blockchain, under the direct control of you the user.

This means that, regardless of the interface used, the ultimate control of the assets remains with the user. Our role, in collaboration with these providers, is to enhance the ease and security of interacting with the blockchain, while ensuring that the fundamental control and ownership of the assets remain with you, the client.

-

Expanded Options and Flexibility for Clients: This diversity in technology partnerships not only strengthens security but also offers clients a broader range of options. Clients can choose from various interfaces and security models according to their preferences and needs, ensuring a more tailored and comfortable experience in managing their Bitcoin holdings.

Partnering with multiple technology providers in our collaborative custody model enhances security, provides operational flexibility, and ensures that clients have a range of choices in managing their Bitcoin. These partnerships are fundamental to our commitment to offering a resilient, client-centric custody solution.

The Bitcoin Adviser’s Security Protocols

Access to our keys is strictly controlled and limited to our business partners. The Global Team of Bitcoin Advisers interacting with clients during education and onboarding phases have NO access to the Bitcoin Adviser key, no access to client accounts, or extensive client details. Additionally they only have access to limited client data for the clients that they are personally working with and no others.

This separation of roles is reinforced by rigorous background checks and regular internal audits, ensuring a robust defence against both internal and external threats.

The Bitcoin Adviser physical key is secured with institutional grade custody, there are multiple physical backups and seed phrase backups on multiple continents on metal plates. Additionally there are key man recovery processes to ensure that the Bitcoin Adviser key is always available so that you can have peace on mind that your Bitcoin is secure and resilient in collaborative custody.

Impossibility of Access by Bad Actors

The design of our security protocols and collaborative custody multisig vaults ensures that a breach is not possible, bad actors cannot access keys or client accounts. Each spending transaction requires initiation by you the client and an additional signature from either the Bitcoin Adviser or the platform provider, each safeguarded by stringent security protocols.

Vested Interest in Maintaining Security

Finally our protocol is also designed to protect not only your funds as a client but also the assets of our Business Partners and Advisers. This shared interest in security underscores our commitment to maintaining the highest standards, ensuring the safety and integrity of all funds under our care.

In summary, the possibility of collusion or unauthorised access within our multisig collaborative custody model is zero.

Our layered security protocols, including your accounts being locked down with your 2FA, collaboration with multiple technology providers, and the inherent features of multisig technology ensure the highest degree of protection for your Bitcoin assets.

We at The Bitcoin Adviser are dedicated to upholding this standard of security and are always available to address any concerns or questions you might have. Please book a call with one of our team to talk this through and address any concerns you may have.